Saturday, November 2, 2019

2020 Open Enrollment Kick-Off

The ACA Open Enrollment Enrollment Period started today and ends on December 15th. Compare new plans and rates @ www.USAIB.org

Thursday, August 22, 2019

Thursday, May 2, 2019

Lowest Premiums Guaranteed

Tel: (623) 688-2411 or 1-800-591-3920

E-mail: USAInsuranceBrokers@gmail.com

Website: www.USAInsuranceBrokers.com

Thursday, April 25, 2019

Thursday, April 11, 2019

2019 Long-Term Care and Home Health Care Costs

How will you cover the costs?

We have several low-cost options that can reduce your financial risk.

2. Short-Term Nursing Home Care (up to 1 Year)

3. Hybrid Life with Accelerated Living Benefits or Long-Term Care Riders

4. Asset Based Long-Term Care

Click Here or go to https://www.usainsurancebrokers.com/long-term-care to watch videos.

Wednesday, April 3, 2019

Bank CD Alternative

- Earn 1%-2% Higher Interest vs Bank CDs

- Tax-Deferred Growth

- 1-10 Year Term Periods

- Safety & Liquidity

- Up to 10% Free Annual Withdrawals

Wednesday, March 6, 2019

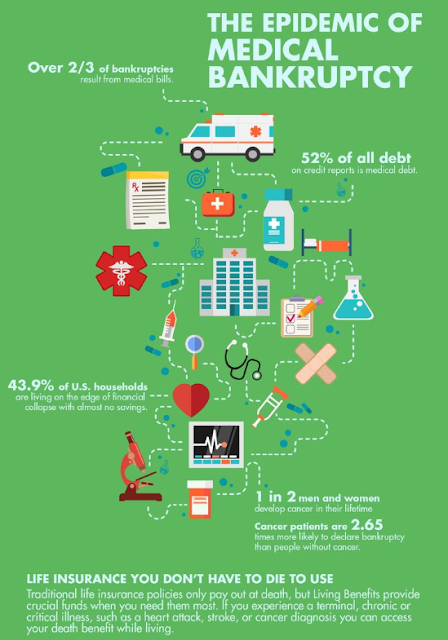

Reduce Financial Risk in 30-Days

Do you have the old or new type of Life Insurance?

In addition to a death benefit, the Accelerated Living Benefit riders can advance up to 90% of the face value (depending upon the severity) in case of Chronic, Critical or Terminal Illness.

Funds can be used for any purpose, such as Deductible, Home Healthcare, Living Expenses, Long-Term Care, Lost Income, Medical Bills, Mortgage Payments, Travel, etc.

Click Here to Watch Video or Click Here to request quotes.

Thursday, February 7, 2019

Wednesday, January 16, 2019

S&P 500 vs Indexed Universal Life

The following chart shows the historical performance of the S&P 500 vs an Indexed Universal Life Policy with a 12% Annual Cap and Zero Downside Risk.

In addition, some Indexed UL policies include Accelerated Living Benefits that can advance up to 90% of the death benefit in case of Critical, Chronic or Terminal Illness. The advanced funds are tax-free and can be used for any purpose, such as Medical Deductible, Household Expenses, Monthly Bills, Mortgage Payments, Long-Term Care, Lost Income, Retirement Income, Travel, etc.

In addition, some Indexed UL policies include Accelerated Living Benefits that can advance up to 90% of the death benefit in case of Critical, Chronic or Terminal Illness. The advanced funds are tax-free and can be used for any purpose, such as Medical Deductible, Household Expenses, Monthly Bills, Mortgage Payments, Long-Term Care, Lost Income, Retirement Income, Travel, etc.

Tuesday, January 15, 2019

Subscribe to:

Posts (Atom)