There are 2 great ways to reduce or fully eliminate your financial risk in case of Accidents or Illness.

Option 1: ACA/Metal Gap Supplemental Benefits

Our Metal Gap Supplemental Benefit plans pay up to $6,350 in case of Accidents and $7,500 for Critical Illness (Cancer, Heart Attack, Stroke, etc.). These low-cost plans can fully offset your deductible and co-insurance in most cases.

Optional Benefits: 24/7 TeleDoc, Hospital and Dental

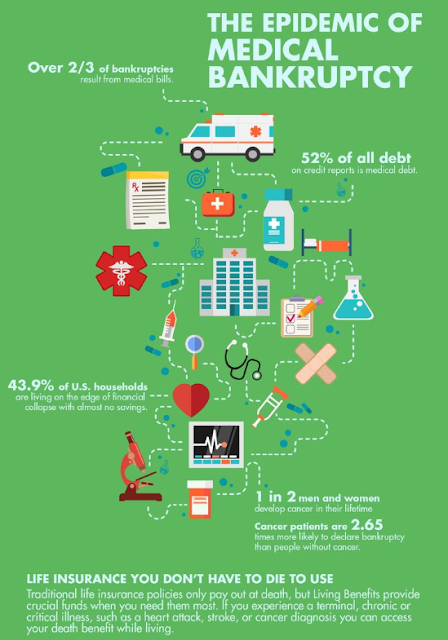

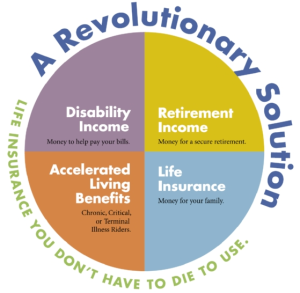

Option 2: Revolutionary Life Insurance - You Don't Have to Die to Use!

Everyone knows someone who suffered a Critical or Chronic Illness and lived. Did their Life policy pay them a benefit? The answer is always NO! And, that is why Living Benefit Life is different.

How much better would their lives have been if they received a check for $100K, $250K or more after developing a serious illness?

Our unique Living Benefit Term (10-30 Years) and Indexed Universal Life (to Age 120) policies are available from 6 insurance carriers. And, the premiums are normally no higher than plans that only pay a Death benefit.

These policies can accelerate up to 100% of the face value (depending upon severity of illness) in case of:

Critical Illness (Cancer, Heart Attack, Stroke, Major Organ Transplant, etc.)

Chronic Illness (Inability to perform 2 of 6 Activities of Daily Living or Cognitive Impairment

Terminal Illness

Death

Funds can be used for any purpose, including: Medical Expenses; Disability Income; Long Term Care; Home Healthcare; Household Expenses; Loan Payments; Mortgage Protection; Childcare; College Funding; Retirement Income; Travel; Final Expenses; Legacy Estate, etc.