Disability Income and Living Benefits Life Insurance are 2 great options in case of Accidents, Chronic or Critical Illness.

Showing posts with label permanent life. Show all posts

Showing posts with label permanent life. Show all posts

Friday, May 14, 2021

Friday, February 12, 2021

The Final Loving Act

Are your loved ones protected? Watch this awesome video.

Instant Quotes @ www.USAInsuranceBrokers.com

Tuesday, September 15, 2020

Thursday, August 22, 2019

Wednesday, March 6, 2019

Reduce Financial Risk in 30-Days

Do you have the old or new type of Life Insurance?

In addition to a death benefit, the Accelerated Living Benefit riders can advance up to 90% of the face value (depending upon the severity) in case of Chronic, Critical or Terminal Illness.

Funds can be used for any purpose, such as Deductible, Home Healthcare, Living Expenses, Long-Term Care, Lost Income, Medical Bills, Mortgage Payments, Travel, etc.

Click Here to Watch Video or Click Here to request quotes.

Friday, June 15, 2018

Low-Cost Financial Protection

In addition to a death benefit, the Accelerated Living Benefits riders can advance up to 90% of the face value (depending upon the severity) in case of Chronic, Critical or Terminal Illness.

Funds can be used for any purpose, such as Lost Income, Long Term Care, Home Healthcare, Living Expenses, Medical Bills, Mortgage Payments, Travel, College Funding, etc.

Friday, March 24, 2017

Reduce Your Financial Risk

Do you worry about your financial risk in case of Critical, Chronic or Terminal Illness?

Our unique Living Benefit Life policies can provide funds to eliminate your financial concerns.

In addition to a Death Benefit, our policies include 3 no cost riders that can accelerate up to 100% of the face value (depending upon severity of illness) in case of:

1. Critical Illness (Cancer, Heart Attack, Stroke, etc.)

2. Chronic Illness or Disability

3. Terminal Illness

Accelerated funds can be used for any purpose, including: Medical Deductible & Co-insurance, College Funding, Disability Income, Household Expenses, Long Term Care, Mortgage, Tax-Free Retirement Income, Travel, etc.

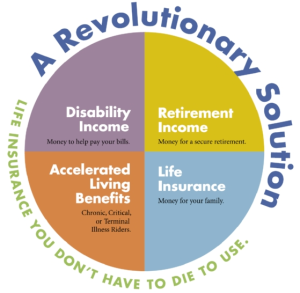

Life Insurance You Don't Have to Die to Use!

Saturday, April 16, 2016

Living Benefit Life Video

Life Insurance + Cash Benefits in case of Chronic, Critical or Terminal Illness. Please contact me for details and quotations.

Monday, October 5, 2015

2 Tips to Reduce Financial Risk

There are 2 great ways to reduce or fully eliminate your financial risk in case of Accidents or Illness.

Option 1: ACA/Metal Gap Supplemental Benefits

Our Metal Gap Supplemental Benefit plans pay up to $6,350 in case of Accidents and $7,500 for Critical Illness (Cancer, Heart Attack, Stroke, etc.). These low-cost plans can fully offset your deductible and co-insurance in most cases.

Optional Benefits: 24/7 TeleDoc, Hospital and Dental

Option 2: Revolutionary Life Insurance - You Don't Have to Die to Use!

Everyone knows someone who suffered a Critical or Chronic Illness and lived. Did their Life policy pay them a benefit? The answer is always NO! And, that is why Living Benefit Life is different.

How much better would their lives have been if they received a check for $100K, $250K or more after developing a serious illness?

Our unique Living Benefit Term (10-30 Years) and Indexed Universal Life (to Age 120) policies are available from 6 insurance carriers. And, the premiums are normally no higher than plans that only pay a Death benefit.

These policies can accelerate up to 100% of the face value (depending upon severity of illness) in case of:

Critical Illness (Cancer, Heart Attack, Stroke, Major Organ Transplant, etc.)

Chronic Illness (Inability to perform 2 of 6 Activities of Daily Living or Cognitive Impairment

Terminal Illness

Death

Funds can be used for any purpose, including: Medical Expenses; Disability Income; Long Term Care; Home Healthcare; Household Expenses; Loan Payments; Mortgage Protection; Childcare; College Funding; Retirement Income; Travel; Final Expenses; Legacy Estate, etc.

Friday, August 14, 2015

Reduce Your Financial Risk in 30 Days!

Life Insurance - You Don't Have to Die to Use!

Everyone knows someone who suffered a Critical or Chronic Illness and lived. Did their Life policy provide a cash benefit? The answer is always NO! Well, that is why Living Benefit Life is different.

How much better would their lives have been if they received a check for $100K, $250K or more?

Our unique Living Benefit Term and Indexed Universal Life policies will accelerate up to 100% of the face value (depending upon severity of illness) in case of:

1. Critical Illness (Cancer, Heart Attack, Stroke, Major Organ Transplant, etc.)

2. Chronic Illness (Inability to perform 2 of 6 Activities of Daily Living or Cognitive Impairment)

3. Terminal Illness (< 24 month Life Expectancy)

4. Death

One policy can provide income protection and the premiums are normally no higher than plans that only pay a Death benefit.

Funds can be used for any purpose, including: Medical Bills; Disability Income; Long Term Care; Mortgage Protection; Nursing/Home Healthcare; Household Expenses; Loan Payments; Childcare; College Funding; Travel; Final Expenses; Legacy Estate, etc.

Living Benefit Life Videos

Please contact me for additional information.

Subscribe to:

Posts (Atom)