The following chart shows the historical performance of the S&P 500 vs an Indexed Universal Life Policy with a 12% Annual Cap and Zero Downside Risk.

In addition, some Indexed UL policies include Accelerated Living Benefits that can advance up to 90% of the death benefit in case of Critical, Chronic or Terminal Illness. The advanced funds are tax-free and can be used for any purpose, such as Medical Deductible, Household Expenses, Monthly Bills, Mortgage Payments, Long-Term Care, Lost Income, Retirement Income, Travel, etc.

Showing posts with label Retirement. Show all posts

Showing posts with label Retirement. Show all posts

Wednesday, January 16, 2019

Friday, April 21, 2017

Safe Certificate of Deposit Alternatives

Why are Fixed Index Annuities and Universal Life Insurance better than CD's, Mutual Funds or a 401(k)?

Click Here to Watch Video or go to https://financialsecurity.video/8103/73

Labels:

401k,

annuity,

fixed index annuity,

Mutual Fund,

Retirement

Saturday, April 16, 2016

Living Benefit Life Video

Life Insurance + Cash Benefits in case of Chronic, Critical or Terminal Illness. Please contact me for details and quotations.

Thursday, March 10, 2016

Increase Your Social Security Benefits

When Should You Claim Your Social Security Retirement Benefits?

One of the most important financial decisions you will ever make is when to begin your Social Security retirement income.

Our new software provides a detailed report that shows the difference between starting benefits at age 62, 66 or 70 and how to maximize your income.

Please contact me for your Free Report!

Friday, August 14, 2015

Reduce Your Financial Risk in 30 Days!

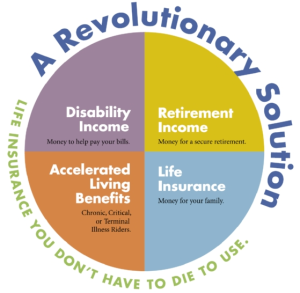

Life Insurance - You Don't Have to Die to Use!

Everyone knows someone who suffered a Critical or Chronic Illness and lived. Did their Life policy provide a cash benefit? The answer is always NO! Well, that is why Living Benefit Life is different.

How much better would their lives have been if they received a check for $100K, $250K or more?

Our unique Living Benefit Term and Indexed Universal Life policies will accelerate up to 100% of the face value (depending upon severity of illness) in case of:

1. Critical Illness (Cancer, Heart Attack, Stroke, Major Organ Transplant, etc.)

2. Chronic Illness (Inability to perform 2 of 6 Activities of Daily Living or Cognitive Impairment)

3. Terminal Illness (< 24 month Life Expectancy)

4. Death

One policy can provide income protection and the premiums are normally no higher than plans that only pay a Death benefit.

Funds can be used for any purpose, including: Medical Bills; Disability Income; Long Term Care; Mortgage Protection; Nursing/Home Healthcare; Household Expenses; Loan Payments; Childcare; College Funding; Travel; Final Expenses; Legacy Estate, etc.

Living Benefit Life Videos

Please contact me for additional information.

Friday, May 15, 2015

Living Benefit Life Advantages vs. Your Policy

Life Insurance - You Don't Have to Die to Use!

Everyone knows someone who suffered a Critical or Chronic Illness and lived. Did their Life policy pay them a benefit? The answer is always NO! Well, that is why Living Benefit Life is different.

How much better would their lives have been if they received a check for $100K, $250K or more?

Our unique Living Benefit Term and Indexed Universal Life policies will accelerate up to 100% of the face value (depending upon severity of illness) in case of:

1. Critical Illness (Cancer, Heart Attack, Stroke, Major Organ Transplant, etc.)

2. Chronic Illness or Disability (Inability to perform 2 of 6 Activities of Daily Living or Cognitive Impairment)

3. Terminal Illness (< 24 month Life Expectancy)

4. Death

One policy can provide income protection and the premiums are normally no higher than plans that only pay a Death benefit.

Funds can be used for any purpose, including: Medical Bills; Disability Income; Long Term Care; Mortgage Protection; Nursing/Home Healthcare; Household Expenses; Loan Payments; Childcare; College Funding; Travel; Final Expenses; Legacy Estate, etc.

Living Benefit Life Videos

Please contact me for additional information.

Labels:

Disability,

Life,

life insurance,

Long Term Care,

Retirement,

term life,

universal life

Friday, August 15, 2014

Protect Your Income and Assets

Life Insurance - You Don't Have to Die to Use!

Everyone knows someone who suffered a Critical or Chronic Illness and lived. Did their Life policy pay them a benefit? The answer is always NO! Well, that is why Living Benefit Life is different.

How much better would their lives have been if they received a check for $100K, $250K or more?

Our unique Living Benefit Term and Indexed Universal Life policies will accelerate up to 90% of the face value (depending upon severity of illness) in case of:

1. Critical Illness (Cancer, Heart Attack, Stroke, Major Organ Transplant, etc.)

2. Chronic Illness (Inability to perform 2 of 6 Activities of Daily Living or Cognitive Impairment)

3. Terminal Illness (< 24 month Life Expectancy)

4. Death

One policy can provide income protection and the premiums are normally no higher than plans that only pay a Death benefit.

Funds can be used for any purpose, including: Medical Bills; Disability Income; Long Term Care; Mortgage Protection; Nursing/Home Healthcare; Household Expenses; Loan Payments; Childcare; College Funding; Travel; Final Expenses; Legacy Estate, etc.

Living Benefit Life Videos

Please contact me for additional information or quotations.

Labels:

Disability,

final expense,

Financial,

Life,

life insurance,

Long Term Care,

Retirement,

term life,

universal life

Location:

Arizona, USA

Wednesday, May 7, 2014

Income Protection Plan

What would happen if you had an accident or critical illness?

We have a variety of low-cost plans that can provide financial protection in case of:

- Accidents

- Chronic Illness

- Critical Illness (Cancer, Heart Attack, Stroke, etc.)

- Disability

- Emergency Room

- Hospitalization

- Surgery

- Long Term Care

- Terminal Illness

- Death

Please contact us for additional information to protect your income and assets.

Tuesday, April 15, 2014

Stock Market Rigged

The U.S. stock market is rigged in favor of high-frequency traders, stock exchanges and large Wall Street banks who have found a way to use computer-based speed trading to gain a decisive edge over everyone else, from the smallest retail investors to the biggest hedge funds, says Michael Lewis in a new blockbuster book, “Flash Boys.”

The insiders’ methods are legal but cost the rest of the market’s players tens of billions of dollars a year, according to Lewis, who spoke with Steve Kroft in his first interview about the book.

High-frequency traders have found ways to use their speed to gain an advantage that few understand, says Lewis. “They’re able to identify your desire to buy shares in Microsoft and buy them in front of you and sell them back to you at a higher price,” says Lewis. “The speed advantage that the faster traders have is milliseconds…fractions of milliseconds.”

Lewis says a former trader at the Royal Bank of Canada in New York, Brad Katsuyama, figured this out after he consistently failed to have his entire order filled at the price he wanted.

Click Here to watch the video report.

According to Wayne Morris, “We have been warning clients of this problem for the past 3 years. Our Indexed Annuities and Universal Life policies provide upside potential growth, but guarantee zero downside risk of loss.”

Labels:

401k,

Financial,

Life,

Long Term Care,

Mutual Fund,

Retirement,

Taxes

Tuesday, March 25, 2014

Saturday, October 26, 2013

Guaranteed Lifetime Income (Video)

Are you tired of the Wall Street Roller Coaster and worrying about market losses?

Watch our Tax-Free Income for Life video. The Safe Money alternative to 401(k), 403(b), CD, IRA, Mutual Funds and Stocks.

- Zero Risk of Loss

- Upside Growth

- Cash Value

- Tax-Free Distributions

- Guaranteed Lifetime Income

http://www.iflretirement.com/USA-Insurance-Brokers

Labels:

Financial,

Life,

Long Term Care,

Retirement

Thursday, August 15, 2013

Are you tired of the Wall Street Roller Coaster?

Is it time to retire your 401(k), 403(b), CD, IRA or Mutual Fund?

Our Safe Money Alternatives can provide:

* 3%-4% Fixed Interest

* Upside Growth based on S&P 500, Nasdaq and/or EuroStoxx

* Zero Downside Risk of Loss

* Accelerated Benefits in case of Critical, Chronic or Terminal Illness

* Cash Value

* College Funding

* Death Benefit

* Disability Income Protection

* Final Expenses or Funeral Trust

* Legacy Estate

* Cash Value

* College Funding

* Death Benefit

* Disability Income Protection

* Final Expenses or Funeral Trust

* Legacy Estate

* Long Term Care Funding

* Mortgage Protection

* Policy Loans

* Tax-Free Lifetime Retirement Income

* Mortgage Protection

* Policy Loans

* Tax-Free Lifetime Retirement Income

Click Here to watch the Tax-Free Income for Life video or go to:

According to numerous reports from 60 Minutes, Employee Benefit Research Institute, NBC, PBS Frontline, Time, Wall Street Journal and many others, most 401(k) and Tax-Deferred plans run out of money in 7-8 years, due to fees and taxes.

Labels:

Disability,

Financial,

Life,

Long Term Care,

Retirement,

Taxes

Income Protection Plan

What would happen to your family if you or your spouse had a serious illness or premature death?

Traditional Life policies only pay a Death benefit to your beneficiaries, but no benefits if you survive.

Our unique Living Benefit Life policies can accelerate up to 90% of of the face value in case of Critical Illness (i.e. Cancer, Heart Attack, Major Organ Transplant, Stroke, etc.); Chronic Illness; Cognitive Impairment; Disability; Terminal Illness; or Death.

Accelerated funds can be used for any purpose, including: household expenses, long term care, medical bills, mortgage protection, college funding, tax-free retirement income, travel, final expenses, legacy estate, etc.

Labels:

Disability,

Financial,

Life,

Long Term Care,

Retirement

Friday, February 15, 2013

Shocking 401(k) Tax Trap Reports

Is it time to retire your 401(k), IRA or Mutual Fund?

According to numerous reports from 60 Minutes, Employee Benefit Research Institute, NBC, PBS Frontline, Time, Wall Street Journal and many others, most 401(k) and other Tax-Deferred plans run out of money in 7-8 years, due to fees and taxes.

If you believe taxes will increase in the future like most Americans and financial experts – why save funds pre-tax? One of the only valid reasons is to receive employer matching contributions. And, even then it may not make sense.

Click

Here

or go to http://www.iflretirement.com/USA-Insurance-Brokers

to watch the Income

for Life video.

Investigative Reports:

Labels:

Financial,

Life,

Long Term Care,

Retirement,

Taxes

Tuesday, November 13, 2012

401(k) Tax Trap

Are you tired of losing money in the market?

There

are over 65 Million people in the USA putting money into tax traps

like a 401(k) every day.

If

you believe taxes will increase in the future like most Americans and

financial experts – why save funds pre-tax?

One

of the only valid reasons is to receive a employer matching contributions. Any

savings above the employer match should be in an after-tax

account, such as Indexed Universal Life Insurance or Lifetime Income Annuity. In

most cases, you will receive a huge increase in net worth, plus

200%-300% more spending money in retirement.

* Guaranteed 3%-4% Fixed Interest

* Upside Market Gains (S&P 500, Nasdaq, DJIA, EuroStoxx, etc.)

* Zero Downside Risk of Loss

* Guaranteed Lifetime Income

* Accelerated Benefits in case of Critical, Chronic or Terminal Illness

* Long Term Care Funding

* Tax-Free Death Benefit

Contact

us @ 1-800-591-3920 or USAInsurance@cox.net

to compare your options and protect your assets.Wednesday, April 11, 2012

Hybrid Policies Increase Financial Protection

New Hybrid Annuities and Living Benefit Life policies, include

financial protection in case of Accidents, Critical Illness, Chronic

Illness, Cognitive Impairment, Disability, Long Term Care and/or

Terminal Illness.

Hybrid policies improve coverage and are significantly less expensive

than individual plans. In addition, many of the policies provide a

Guaranteed Lifetime Income.

Please contact us @ 1-800-591-3920 or USAInsurance@cox.net

for additional information.

Labels:

Financial,

Health,

Life,

Retirement

Thursday, February 2, 2012

Living Benefit Life Videos

Do you have adequate coverage to protect your family, home and

assets?

Click Link for video and testimonials or go to http://www.youtube.com/user/USAInsurance

Our unique "Living Benefit" Life policies accelerate up to 100% of the face value in case of Critical Illness (Heart Attack, Stroke, Cancer, etc.); Chronic Illness; Cognitive Impairment; Terminal Illness; or Death.

One policy can provide low-cost financial protection to cover: Medical Bills; Disability Income; Long Term Care; Nursing/Home Healthcare; Mortgage Protection; Household Expenses; Childcare; College Funding; Travel; Final Expenses, etc.

Premiums are no higher than policies that only pay a Death benefit and significantly lower than Critical Illness, Disability and Long Term Care plans. Please contact us for quotations.

Click Link for video and testimonials or go to http://www.youtube.com/user/USAInsurance

Our unique "Living Benefit" Life policies accelerate up to 100% of the face value in case of Critical Illness (Heart Attack, Stroke, Cancer, etc.); Chronic Illness; Cognitive Impairment; Terminal Illness; or Death.

One policy can provide low-cost financial protection to cover: Medical Bills; Disability Income; Long Term Care; Nursing/Home Healthcare; Mortgage Protection; Household Expenses; Childcare; College Funding; Travel; Final Expenses, etc.

Premiums are no higher than policies that only pay a Death benefit and significantly lower than Critical Illness, Disability and Long Term Care plans. Please contact us for quotations.

Tuesday, July 19, 2011

Are You Worried About Outliving Your Savings?

Increasing longevity and decreasing job security means the average American will spend 20-30 years in Retirement. In fact, recent studies indicate that running out of money has replaced death as the #1 concern for most individuals. Are you prepared?

Do you have funds in a 401K, CD, IRA, Money Market, Mutual Fund or Savings Account with low or no returns?

We have a variety of plans that offer the following advantages:

- 5%-10% Bonus on Deposits

- 5%-8% Annual Interest

- Upside Market Gains

- Zero Downside Risk

- Guaranteed Lifetime Income

Please contact us @ 1-800-591-3920 or USAInsuranceBrokers@gmail.com for information on strategies to protect your assets.

Thursday, January 6, 2011

Low-Cost Financial Protection Plan

Do you have adequate coverage to protect your family, home and assets in case of Critical or Chronic Illness; Disability; Long Term Care; Terminal Illness; or Death?

What would happen if you had a serious accident or illness and could not work for 3-6 months or longer? Would your family lose their home, assets and savings?

Revolutionary Life provides a low-cost solution that pays up to 100% of the face value as Accelerated Living Benefits. Funds can be used for any purpose, including: Medical Bills; Long Term Care; Lost Income; Mortgage Protection; Household Expenses; College Funding; Travel; Final Expenses, etc.

Premiums are normally no higher than plans that only pay a Death benefit and significantly less expensive than standalone Critical Illness, Disability and Long Term Care policies.

Contact us @ 1-800-591-3920 for additional information

Thursday, October 7, 2010

What is the best and safest Retirement Plan?

What do experts agree is the best and safest Retirement Investment Plan?

Indexed Universal Life Insurance (IUL) is a Tax Free investment that puts the owner in control of their retirement and not Uncle Sam!

It’s perfect for individuals and business owners and has more “living benefits” than the actual death benefit that is included with the investment. These policies are not classified as “Qualified Plans” by the IRS, so they are the perfect investment to save for retirement. An IUL is a permanent cash-value life insurance product that is designed to outperform Whole Life, Universal Life and Variable Life without the catastrophic downside risk. In fact, zero downside risk!

Universal Life is considered to be the best possible vehicle for Tax-Free Retirement Savings, College Funding, Financial Protection and Retirement Savings.

The Tax-Free Income derived from the IUL policy can be far greater than the after tax income from a 401-K, 403-B, Certificates of Deposit, Annuities, Stocks, Bonds or an IRA.

IUL policies provide the following advantages:

* Cash Value

* Flexible Premiums

* Guaranteed to Age 120

* Interest based on 140% of S&P 500 (Ex. 5% Actual = 7% Gain)

* Minimum 2% Fixed Interest Rate

* Policy Loans

* Tax-Free Retirement Benefits

* Upside Gains with Zero Downside Risk

In addition, one of our plans pays up to 75% of the face value in case of Critical Illness, Chronic Illness, Disability, Long Term Care or Terminal Illness at no additional charge.

Indexed Universal Life Insurance (IUL) is a Tax Free investment that puts the owner in control of their retirement and not Uncle Sam!

It’s perfect for individuals and business owners and has more “living benefits” than the actual death benefit that is included with the investment. These policies are not classified as “Qualified Plans” by the IRS, so they are the perfect investment to save for retirement. An IUL is a permanent cash-value life insurance product that is designed to outperform Whole Life, Universal Life and Variable Life without the catastrophic downside risk. In fact, zero downside risk!

Universal Life is considered to be the best possible vehicle for Tax-Free Retirement Savings, College Funding, Financial Protection and Retirement Savings.

The Tax-Free Income derived from the IUL policy can be far greater than the after tax income from a 401-K, 403-B, Certificates of Deposit, Annuities, Stocks, Bonds or an IRA.

IUL policies provide the following advantages:

* Cash Value

* Flexible Premiums

* Guaranteed to Age 120

* Interest based on 140% of S&P 500 (Ex. 5% Actual = 7% Gain)

* Minimum 2% Fixed Interest Rate

* Policy Loans

* Tax-Free Retirement Benefits

* Upside Gains with Zero Downside Risk

In addition, one of our plans pays up to 75% of the face value in case of Critical Illness, Chronic Illness, Disability, Long Term Care or Terminal Illness at no additional charge.

Subscribe to:

Posts (Atom)