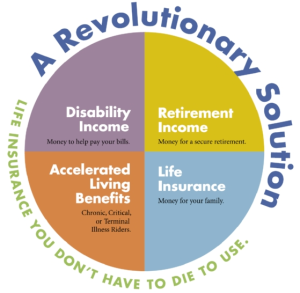

Revolutionary Life Insurance - You Don't Have to Die to

Use!

Do you have the old type or new

type of insurance?

Everyone knows someone who

suffered a Critical or Chronic Illness and lived. Did their Life policy

pay them a benefit?

The answer is always NO! And,

that is why Living Benefit Life is different.

How much better would their lives

have been if they received a check for $100K, $250K or more after

developing a serious illness?

Our unique Living Benefit Term

(10-30 Years) and Indexed Universal Life (to Age 120) policies are available

from 6 insurance carriers. And, the premiums are normally no higher

than plans that only pay a Death benefit.

These policies can accelerate up

to 100% of the face value (depending upon severity of illness) in case of:

1. Critical Illness (Cancer,

Heart Attack, Stroke, Major Organ Transplant, etc.)

2. Chronic

Illness (Inability to perform 2 of 6 Activities of Daily Living or

Cognitive Impairment)

3. Terminal Illness

4. Death

Funds can be used for any

purpose, including: Medical Expenses; Disability Income; Long Term Care;

Home Healthcare; Household Expenses; Loan Payments; Mortgage Protection;

Childcare; College Funding; Retirement Income; Travel; Final Expenses;

Legacy Estate, etc.